Audit & Assurance

Tax, VAT & Company Affairs

Business Advisory and Outsourcing

Non-audit Assurance Services

Audits of Financial Statements

Audit & Assurance

Audits of Financial Statements

Audits of Financial Statements

Non-audit Assurance Services

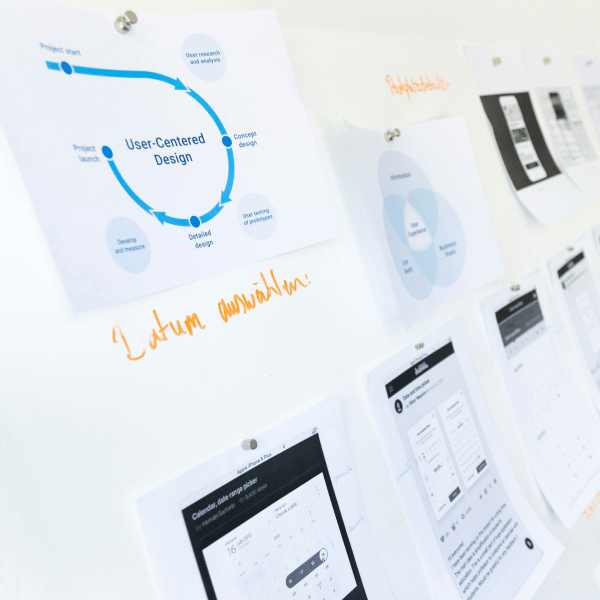

Companies that successfully address the financial audit issues, improve the quality of their financial reporting process, and stand to gain global credibility with leading sources of capital. Audit services have been long associated with the traditional domain of verification and assurance. However, in line with the recent shift in global audit perspective, we have realigned ourselves and have shifted our focus on the creation of value for the entities being audited.

The regulatory environment for corporations in Bangladesh is growing in complexity and auditors are now in a partnership with their clients in ensuring that compliance is made to the emerging needs of reporting and regulatory requirements. The business environment is rapidly changing and new challenges are constantly creating new opportunities. The stakeholders, particularly the shareholders, need accurate, timely, and reliable financial information to be able to take correct decisions in prioritizing the use of their investments and resources. The same information is also demanded by the audit committees who have to oversee the management of affairs by the company. Thus, the role of auditors can now easily be spoken as assurance providers as well as advisors to various stakeholders.

At SOHEL RASEL & CO. we are redefining our role that not only we provide the required assurance but also help the corporations to identify and manage the risks. We are creating value for our clients by helping them identify and understand the risks that so far have not even arisen to a prominent level. Since, competing globally, the businesses have to be proactive on risk management, we are there to help them in this ever-complex process.

Our core areas of audit and assurance comprise the following:

- Statutory audits of Financial Statements

- Management audits

- Internal control and corporate governance reviews

- Certifications on regulatory requirements

- Compilations and other agreed upon procedures

- Advice on accounting standards and corporate accounting practice

- Financial analysis & budgeting

- Compliance audits

- Agreed-upon procedures

- Stock-counts & asset-counts

- Control assessment & validations

- Forensic audits

Tax, VAT & Company Affairs

- Corporate Taxation

- Personal Taxation

- Value Added Tax (VAT)

- Transfer Pricing

- RJSC&F and Company Affairs

Successful companies consider tax implications before they make business decisions. Our Tax department is supervised and managed by Senior Chartered Accountants equipped with top-notch skills in direct and indirect taxation. As a tax consultant, we assist our valuable clients in tax planning to enhance the tax efficiency within legal parameters as well as providing planning and advising on strategizing tax implications. We adhere to the highest standards of ethics including but not limited to integrity, confidentiality, professional behavior, and due care while rendering our services to the clients.

We believe in developing a close relationship with our clients, which enables us to understand the business process which is of core importance in recommending a suitable tax-efficient business model. We provide a work environment for our people that attracts, develops, and challenges the most talented professionals. We handle matters of every type and size ranging from individuals to multinational organizations.

Business Advisory and Outsourcing

- Accounting Services and Bookkeeping

- Corporate Finance

- Risk Advisory Services

- IT Security and Assurance Services

- HR & Payroll Support

Our vast experience and our reputation for delivering quality work has enabled us to be selected by our clients to carry out consulting assignments of varied nature. Many acquisitions fail to live up to expectations. The reasons range from poor deal structure, poor strategic fit, failure to identify problems with the quality of earnings, overly optimistic estimates of synergies, to lack of an integration plan. Evaluating a company in another country compounds these risks. You are dealing with different language and cultural barriers; different business ethics, legal systems, filing regulations, and accounting principles; transfer pricing that affects taxation and often government involvement. But international deals often provide the best growth opportunities. They can offer improved returns from economies of scale, new target markets for existing products/services, access to commodity materials, and a hedge against seasonality.

Even savvy managements and private equity investors cannot know everything they should to make a deal successful, so they need an experienced financial advisor.

We provide advisory and compliance services with regard to corporate laws and regulations as applicable in Bangladesh. We also work in close coordination with the regulatory bodies like NBR, BIDA, BSEC, DSE, CSE, Bangladesh Bank, NGO Affairs Bureau and other regulators to meet the compliance requirements and to represent client on various issues.

The list of services includes the following:

- Company and other special legal body incorporation

- Registration with various regulatory authorities

- Corporate statutory and regulatory compliance and services

- Liaison and branch office registrations

- Foreign and local NGOs registrations

- Providing complete corporate secretarial services inclusive of maintenance of the Company’s minutes and all other Company law’s procedures

- Further issuance of capital, alteration in memorandum

- Incorporation and registration of local and global companies

- Drafting contractual agreements, partnerships, and various deeds

- Liquidation of companies; etc.

“Their expertise and their data-driven approach allowed us to optimize our campaigns for maximum impact.”

MARIA STEVENS

Value Added Tax (VAT)

HR & Payroll Support

Let’s work together on your next project

Join Our Team & grow Your Career with a firm that values innovation, integrity, and impact..